Consumer Grievance

Grievance Redressal

CRIF Connect has Customer Grievance Redressal Mechanism Policy in place as per directions issued by Reserve Bank of India (RBI) on Fair Practices Code for Non-Banking Financial Companies (NBFCs).

Our Customer Grievance guideline applies to all the Customers / Citizen of India availing Account Aggregator services of CRIF Connect. It has been framed to resolved customer grievances in a timely and effective manner.

Customer service is extremely important for sustained business growth and as an organization we aim to provide our customers with exemplary service. Customer complaints constitute an important voice reflecting our performance, and this policy details complaint handling through a structured grievance redressal framework. Our redressal process is also supported by a review mechanism, to minimize the recurrence of similar issues in future.

- Customers are always treated fairly

- Complaints raised by customers are dealt with courtesy and in a timely manner

- Customers are informed of avenues to escalate their complaints within the organization, and their rights, if they are not satisfied with the resolution of their complaints

- The employees work in good faith and without prejudice, towards the interests of the customers

- The touchpoints and timelines for resolution of complaints from customers will be part of customer website for easier access to information

Grievance Redressal Mechanism

CRIF is committed to provide customers with best-in-class experience. Whilst all efforts are in place to provide the best services to avoid any grievances, the customers have the ability to raise grievances through the below mentioned methods:

Customers can write to support.aa@crif.com to raise a redressed request with the following details

- Subject Line – Grievance issue or concern

- Date of the event

- AA VUA ID or Registered Mobile number

- Details of the grievance / compliant

Please note that for effective resolution of the grievance, we will need information and necessary details relevant to such grievance from respective customer.

Customer grievance redressal process

- Acknowledgment along with the token / case number will be shared with customer within 24 hours of receiving any grievance from customer

- Resolution to the concern would be provided within 10 days of receiving the request from customer.

- Customer shall be notified of any changes in status of the redressal, along with the action taken and reason for delay if any.

- In case the customer is unhappy with the resolution or the pace of resolution, they can escalate the same to personnel mentioned in the ESCALATION MATRIX, refer section below

- In case the concern is unaddressed even after 30 days from the time when CRIF Connect sent an acknowledgement, customer can approach RBI for resolution as per The Reserve Bank of India (RBI) master directions.

Escalation Matrix for Customer Grievance Redressal Mechanism

| Escalation | Timeline | Customer / Citizen Action | CRIF Connect Action |

|---|---|---|---|

| Level 1 | Day 0 of filing the grievance | Customer sends an email to support.aa@crif.com with the required details.Registered Office: Unit 601, 6th Floor, Axis Centra Building, Off PAN Card Club Road, Baner, Pune-411045 | CRIF Connect will send acknowledgement within 24 working hours of receiving the grievance with an aim to resolve the issue within 10 days. |

| Level 2 | After 10 days | If the grievance is not resolved within 10 days, then customer can reach CRIF Connect Grievance Redressal Officer Phone:9730261232 Email: grievance.aa@crif.com |

For, any grievances raised as a Level 2 escalation, CRIF Connect will ensure such issues / grievances are resolved within next 20 days. CRIF Connect will keep the customer informed on the progress towards grievance resolution and delays (if any) |

| Level 3 | After 30 days | As per RBI Master Directions, if the complaint/grievance is not resolved within a period of one month / 30 days from reporting, you may appeal to the Reserve Bank of India (RBI). |

|

Customer Support Timings: Active Days: Monday to Friday: 9:00 AM to 5:00 PM (local time) Closed: Saturdays, Sundays, Public Holidays, National Holidays, and Bank Holidays Please note that specific dates for public holidays, national holidays, and bank holidays may vary depending on the country or region where the company or organization is located. It requested to kindly check with the company's customer service team for the most up-to-date information on their support hours. |

|---|

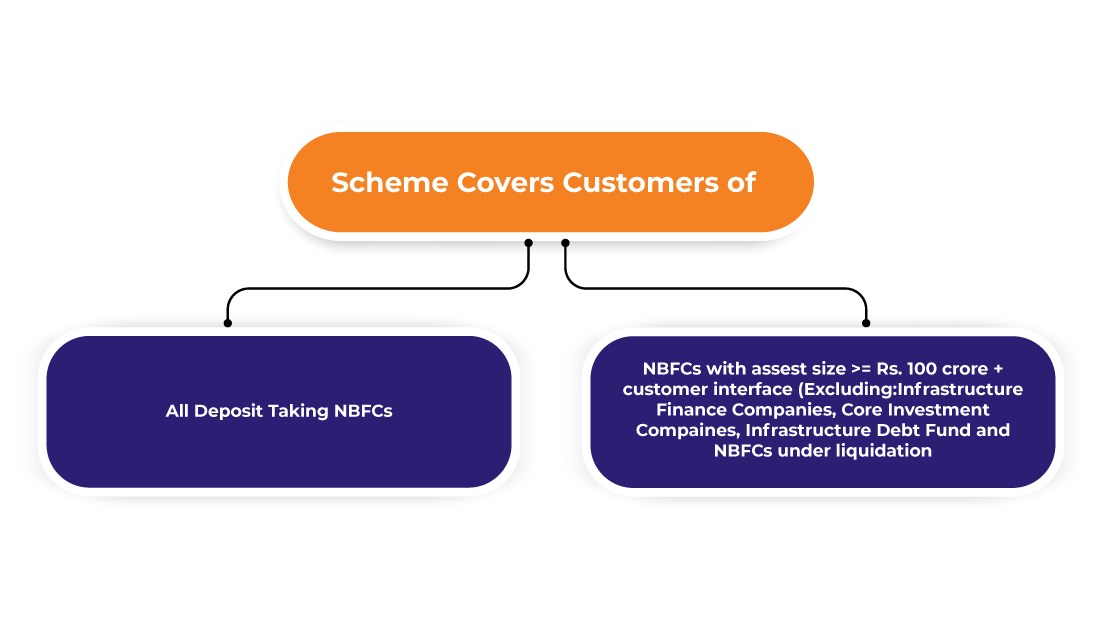

Ombudsman Scheme for Non-Banking Financial Companies, 2018 :Salient Features

Grounds for filing a complaint by a customer:

- Interest/Deposit not paid OR paid with delay

- Cheque not presented OR done with delay

- Not conveyed the amount of loan sanctioned, terms & conditions, annualised rate of interest, etc.

- Notice not provided for changes in agreement, levy of charges

- Failure to ensure transparency in contract/loan agreement

- Failure/ Delay in releasing securities/ documents

- Failure to provide legally enforceable built-in repossession in contract/ loan agreement

- RBI directives not followed by NBFC

- Guidelines on Fair Practices Code not followed

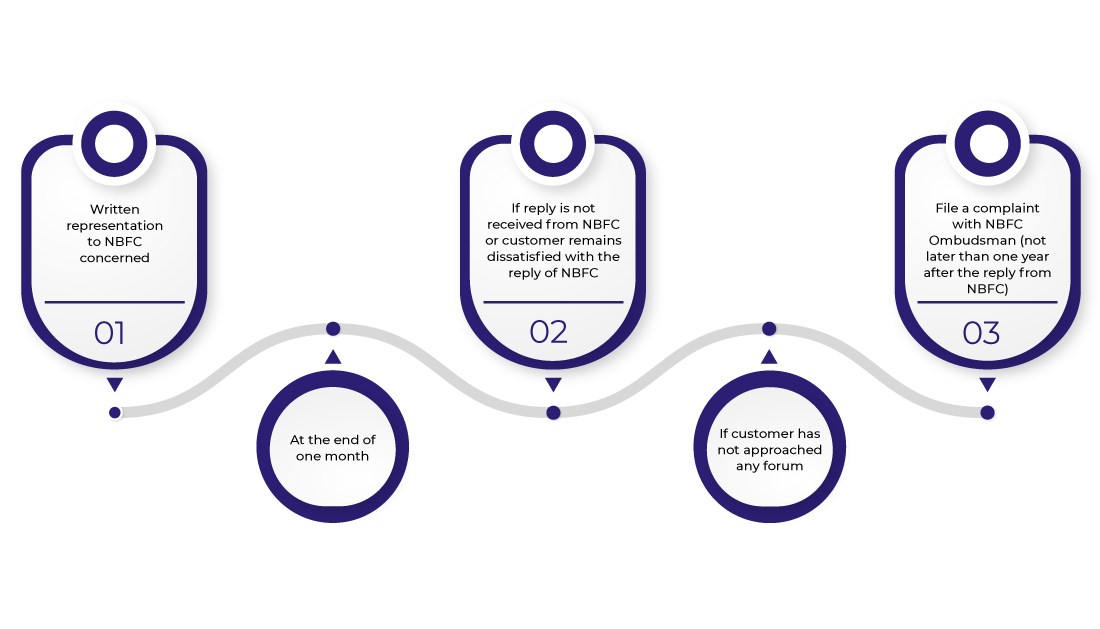

How can a customer file complaint?

How does Ombudsman take decision?

- Proceedings before Ombudsman are summary in nature

- Promotes settlement through conciliation If not reached, can issue Award/Order

Can a customer appeal, if not satisfied with decision of Ombudsman?

Yes, If Ombudsman’s decision is appealable Appellate Authority: Deputy Governor, RBI

Note:

- This is an Alternate Dispute Resolution mechanism

- Customer is at liberty to approach any other court/forum/authority for the redressal at any stage

Refer to www.rbi.org.in for further details of the Scheme